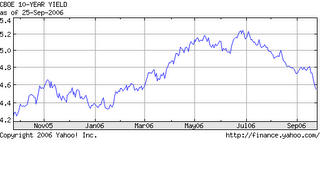

Ten-year T-note yields hit 4.55% yesterday, the lowest level in about 7 months, since February 28 (see graph above).

From today's WSJ front page:

In one of the bigger surprises in financial markets this year, a growing sense that the economy is slowing and inflation receding is fueling a rally in the nation's bond markets, pushing Treasury-bond yields to their lowest levels in months.

Because bonds pay fixed interest, their yields go down as investors bid up their prices, and vice versa. Earlier this year, Treasury yields rose as investors fretted that a strong economy would pump up inflation. Inflation eats away at bond returns, so investors dumped Treasurys, which pushed bond prices lower and their yields higher.

Now, in the upside-down world of bond investing, bad news about the economy has investors turning back to bonds, which is pushing yields back down, essentially making it cheaper to borrow money.

No comments:

Post a Comment