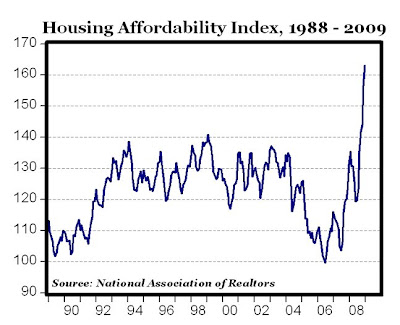

Mortgage rates fell today to an historic record-low of 4.96% (see chart above), "the lowest mark since Freddie Mac started tracking the data in 1971." That should help push the Housing Affordability Index (HAI) to a new estimated record high level of 163.1 in January (see chart below). The National Association of Realtors (NAR) has HAI data through October 2008, and I have estimated the HAI for November, December and January using the NAR methodology.

Mortgage rates fell today to an historic record-low of 4.96% (see chart above), "the lowest mark since Freddie Mac started tracking the data in 1971." That should help push the Housing Affordability Index (HAI) to a new estimated record high level of 163.1 in January (see chart below). The National Association of Realtors (NAR) has HAI data through October 2008, and I have estimated the HAI for November, December and January using the NAR methodology. A HAI of 163.1 would mean that the typical household earning the median family income of $60,840 (estimated) in January would have 163.1% of the qualifying income to purchase a median-priced existing single-family house ($181,000 - estimated for January) with a 20% down payment, which would be the highest level of housing affordability in history.

A HAI of 163.1 would mean that the typical household earning the median family income of $60,840 (estimated) in January would have 163.1% of the qualifying income to purchase a median-priced existing single-family house ($181,000 - estimated for January) with a 20% down payment, which would be the highest level of housing affordability in history. Stated differently, the annual qualifying income required to purchase a median-price house (with a 20% down payment) is only $37,296, with monthly payments based on a 4.96%, 30-year fixed-rate mortgage ($777 per month for principal and interest). Given the median family income of about $60,840 (est.), the typical family would have 163.1% of the income required to qualify for the mortgage to purchase the $181,000 home.

No comments:

Post a Comment